Everywhere you look there's lag

To better read the tea leaves, it pays to look at how systems work

What do London Heathrow’s flight caps, the inventory of retailers, interest rate policies, and the energy transition have in common? All are subject to systems lag and experiencing the effects.

Current world events show the importance of understanding systems and the inherent delays therein. By knowing what to look for, one can better see the forest from the trees. The best way to view the world is as it is. The tangible and intangible components of our lives are comprised of embedded systems.

System lags are all around us:

An unexpected result of COVID saw retailers struggling to maintain physical inventories in the face of high demand and supply chain issues. Orders were placed based on current demand, which had fallen off once the products arrived. Supply chain snarls added to the delays receiving orders, compounding inventory issues. Over-ordering was the natural result, and retailers are now forced to discount products to move them.

The term commonly used to describe retail’s present inventory dilemma is the bullwhip effect: demand and/or supply distortions result in disequilibrium between what the consumer wants and what’s available.

It’s the same thing as system delays but with a sexier name attached. We have seen it continue it play out with orders still arriving from Asia despite demand disintegration.

These orders were caught up in the supply chain logjam when demand was stronger, and are now flooding in at precisely the wrong time. The next step is companies cutting orders even more to counteract unnecessary orders, which will weigh on economic data.1

Central Banks as a whole have been behind the ball on tightening financial conditions in the face of higher inflation. Now there are risks they could eventually over-tighten. Indeed, the hit rate for a smooth economic landing by the Federal Reserve is small.

The savings and loans crisis was exacerbated by the mismatch between asset and liability duration. The Fed policy’s decisions are magnified by information mismatches. By relying on time-delayed inputs for future interest rate decisions, risks are more elevated for either under-correction or over-correction. These lagged key information inputs include inflation data (i.e. CPI and PCE) and the unemployment rate.2

Quantitative Tightening (QT) adds another wrinkle that no one truly knows the impact of because we have never been in this environment before. Today is quite different from the taper tantrum in that the Fed’s hands are more tied from backing off. Even if it doesn’t actively sell off its bond stock, as they mature the balance sheet will naturally shrink.3

The ECB is even further behind the ball than the Fed when it comes to interest rate hikes. As shown below, the current Fed Funds rate is 2.25% - 2.5%.

Conversely, the European Central Bank’s (ECB) main refinancing rate (equivalent to the Fed Funds rate) is only 0.5%.

The delta between the Fed and ECB tightening is showing up in euro parity with the dollar. It’s the first time in over 20 years the exchange rates have been equal. The euro has significantly weakened as the Fed has raised interest rates faster than the ECB, causing money flows to shift towards the United States.4

It would behoove Americans to travel internationally given the stronger dollar compared to a host of currencies. However, travelers are running headfirst into more system delays flying. Out of the 100 busiest airports, the majority have seen at least 20% of flights being delayed according to the WSJ. The most egregious flight delays are located in Canada at over 50%.

Due to staffing shortages resulting in 42% of flights being delayed, London Heathrow is capping the number of daily departing passengers to 100,000 compared to 220,000 pre-COVID. Amsterdam’s Schiphol Airport is restricting the number of departing passengers as well.

When COVID hit, airports and airlines en masse eliminated jobs. The rebound has caught them woefully underprepared and will not go away quickly. It takes months to train people and years for them to reach maximum efficiency.

For pilots, the training period is several years. In other words, we will be dealing with the after effects of decisions made during COVID in air travel for an extended period. And it will be worse when it comes to pilot shortages. For years, the number of pilots coming onboard has been diminishing. Regional routes will suffer the most.

The war in Ukraine has led to cascading impacts for energy and food prices. Russia and Ukraine supplied 30% of worldwide wheat and barley. Ukraine also exported over 50% of global oilseed supplies (sunflower, soybeans, rapeseed). Wheat prices have retreated to prewar levels, but it may be shortsighted to extrapolate this trend as being back to normal.

According to Doug Hurt, who specializes in the history of agriculture, “Wars typically have a lasting impact on farmers. After World War I, it took several years for European grain production to recover….Years, often a decade or more, are required to return agriculture to a semblance of normal after a war.” This year’s Ukrainian wheat harvest in Ukraine will be slashed by anywhere from 30% to 70%.

Even with the deal reached to ship grain out of Ukraine safely, at best it will take months to reach pre-war shipping amounts.5 (Further, we will see if Russia keeps to the deal terms. A cursory look at how Russia operates in past wars easily demonstrates how little they value keeping their word. As we’ve seen with their systematic targeting of civilians, their military would shoot you point blank and then act offended at your “accusation” of being shot by them.)

The energy transition is an excellent case study in systems and how the “shoot first, ask questions later” strategy emblematic in politics can backfire for their constituents. In their attempt to supercharge the movement to “green energy”, they have neglected how long energy transitions take and burdened those with the least amount of capacity to absorb their errors.

Professor Vaclav Smil has stated energy transitions take decades: “In the U.S. and around the world, each widespread transition from one dominant fuel to another has taken 50 to 60 years.”

The science is at odds with policies treating the transition like upgrading to a newer model car.6

Oil and gas stocks suffered a downturn in 2015 - 2016 as the market focus shifted from growth at any cost to profitability. Since then, there has been ongoing underinvestment in O&G capex.

Sustainable underinvestment causes supply to shrink while energy demand continues to increase over time. Bringing on renewables is not enough to fill the gap, meaning prices have to rise to reach demand/supply equilibrium. Instead of peak oil, we are grappling with peak investment:

Energy stocks are not showing signs of meaningfully turning up production growth and instead are focused on profitability and shareholders returns. For those firms looking to fire up drilling, they are running into 30% - 40%+ cost inflation, which materially hits return rates (yes, even with higher oil prices).

Everywhere you look, there are delays which are inherent in systems. Increased system complexity shows how small changes in one place result in reverberations greater than the initial input.

These lags run counter to our conditioned desire for instantaneous feedback. The world is only becoming more complex in its interconnections. Looking at the world through the worldview of system materially aids in distinguishing the news from the noise. And hopefully, you become a better investor through this process.

Systems Appendix (what are systems, how do they work, and an explanation of inherent delays):

What is a system?

Every human, organization, animal, economy, and government is a complex system (with systems within this system which are called embedded systems). Another way to state this is as:

“an interconnected set of elements that is coherently organized in a way that achieves something. The system may be buffeted, constricted, triggered, or driven by outside forces. But the system’s response to these forces is characteristic of itself, and that response is seldom simple in the real world.” - Thinking in Systems

It is more than the sum of its parts - it can exhibit adaptive, dynamic, goal-seeking, self-preserving, and sometimes evolutionary behavior. They can be self-organizing, self-repairing, and resilient. Get all that? Let’s break it down into its essential parts.

A system must contain three things:

Elements: the building blocks; for a tree it’s the roots, branches, and leaves.7 Includes the intangible and tangible. For example, the bits within a computer are intangible.

Interconnections: relationships holding the elements together. In a tree system, it would be the physical flows and chemical reactions. Interconnections often operate via the flow of information. These flows of information are signals for the decision/action/leverage points within a system.

Function/Purpose: what is its aim; can only be deduced by its behavior. The purpose of nearly every system is to safeguard its survival. Further, successful systems work to keep sub-purposes and overall system purposes in harmony. The cells in your heart are different from your liver, but both function to keep you alive.

Of the three building blocks, changing the elements typically has the smallest effect on the whole. Swapping out all the players on a football team still makes it a football team. A human body regularly replaces its cells but continues to be a human body. Countries have regular elections, with different politicians occupying offices, yet nothing seems to change. As long as the interconnections and functions remain intact, a system generally goes on doing its thing.

Altering the function is often the most crucial determinant of a system’s behavior. It would be like if an animal’s purpose was changed from survival/reproduction to pleasure.

However, this is not to take away from the fact that elements, interconnections, and purpose are essential. If changing an element results in a changed relationship or purpose, de facto behavior is modified. Adjusting interconnections (the information flows) can materially affect a system - imagine changing the rules of football to those of soccer.8

The system interacts with outside forces, but, importantly, its response is of its own character. Another way to say it is it has its own latent behavior within its structure.

However, a system’s behavior cannot be known based purely upon adding together its elements. Humans tend to think linearly, which is not necessarily how systems act.

Systems are often nested within other systems. As such there are purposes within purposes. According to Friedman’s economic theory, the purpose of a corporation is to maximize shareholder returns. Within that business, the purpose of the C-Suite may be to serve customers well or make as much money as possible anyway possible. Down at the middle manager role, the goal may be not to get fired. At the junior level it could be promotion and earning more money.

As you can see, often the sub-purposes come into conflict with the overall purpose at businesses. Like with individuals, the greater the sense of coherence within the corporation, the better the results.9

What is not a system? An assortment of things without any specific interconnection or function.

"Sand scattered on a road by happenstance is not, itself, a system. You can add sand or take away sand and you still have just sand on the road.” - Thinking in Systems

Lags are inherent in systems due to their structure - it takes time for a given input to result in an output. Goods ordered from China do not instantaneously appear in a company’s warehouse.

To understand lags, first we need to take a step back into how the elements of a system are set up. The foundation of any system is its stock. These are the store, the quantity, the accumulation of material or information built up over time. You can see, count, or measure these items. The money in your bank account, the water in a bathtub, trees in a forest, or the population of a country are all examples of stocks.

Flows cause stocks to change. It’s the bathtub filling and draining, the births and deaths within a country, the dying and planting of trees in a forest, deposits and withdraws in a bank account. To understand much of the behavior of complex systems, one must understand the interplay of its stocks and flows.

A critical point is stocks typically change slowly. A forest doesn’t become deforested all at once. It takes a while for the population to unlearn skills. Groundwater can be pumped out at a faster rate than it is replenished for a long time. This occurs even when flows into or out of them change suddenly. Think of how much long it takes for trees to accumulate into a forest. Or for a productive labor force to be built up.

As such, stocks form the basis of system delays. They can also serve as system buffers. Just-in-time inventory has reduced the buffer of stocks. Taking slack out of the system results in decreased resiliency.

Time lags aren’t all bad - the stocks can be sources of stability…for a while. These delays allow room to experiment and revise policies that aren’t working.

Stocks allow inflows and outflows to be independent of each other and temporarily out of balance. Reservoirs allows residents and farmers to live downriver without adjusting their lives to a river’s yearly flows. But if hard rains happen for years, eventually the river will flood.

“Systems thinkers see the world as a collection of stocks along with the mechanisms for regulating the levels in the stocks by manipulating flows. That means system thinkers see the world as a collection of ‘feedback processes.’” - Thinking in Systems

If a system demonstrates a persistent behavior over time, the odds are good there’s a mechanism creating this consistency. It is manifested through a feedback loop. To find feedback loops, look for a system’s consistent behavior.10 Feedback loops can stabilize or de-stabilize systems. They can cause stocks to increase or decrease.

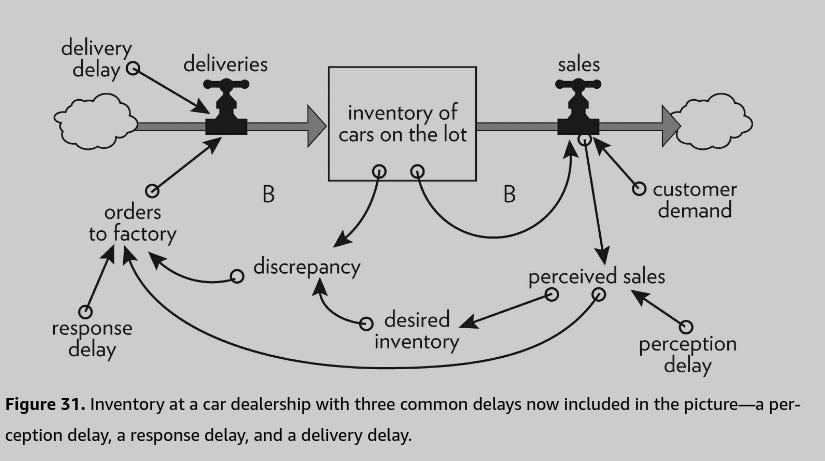

Donella Meadows in her excellent book on systems speaks of three types of delays: 1) perception delay; 2) response delay; and 3) delivery delay. Below shows the system flows for a car dealership’s inventory:

The perception delay is intentional in this case. How often does the dealer react to changes in sales? Does he go off of daily, weekly, monthly, or some average? It’s key to pick the right time period to sort out real trends from noise.

Response delay is how much he orders. Does he order the whole lot needed or make partial adjustments to make sure the perceived trend is real?

The delivery delay is how long it takes to receive vehicle orders onto the lot.

Inventory oscillations result in a system where there are delays. Here’s a simplified example of a permanent sales increase combined with lags:

Think about it: sales increase, causing vehicles on the lot to drop. Once they are sure the higher sales rate will last, more cars are ordered. The delivery delay means it takes time for the orders to actually arrive.

Yet during the interim period before orders hit the lot, inventory drops further if sales sustainably rise, meaning available inventory continues to decrease, so orders bump up a little more to bring inventory back to prior levels.

The larger volume of orders begins arriving, and, instead of recovering, inventory can shoot up more than expected, and the dealership can quickly turn from under-inventoried to over-inventoried. Orders are cut back, but elevated past orders are coming in, so less is ordered. Inventory eventually falls and can become too low.

The above example shows how retailers are now wrestling with too much physical inventory. Management struggles to obtain timely information in the system, whether from consumers or suppliers.

Add to this the inability for actions to have an immediate impact on order because of system lags, and one can see how the inventory system struggles to find homeostasis. In this case, it was the double whammy of over-estimating demand and supply chain logjams.

The bullwhip effect was a big support for economic activity in 2021 given the massive restocking retailers undertook, which cascaded through the supply chain. This more than made up for below trend services spending.

It’s no surprise that these are relied upon heavily given the Fed’s dual mandate of price stability and maximum sustainable employment.

I guess it could keep the balance sheet unchanged, by replenishing maturities rolling off. This is not currently on the table.

The same dynamics seen with the ECB and the United States can be applied to the Bank of England (in terms of the BOE being behind the Fed on interest rate hikes and sterling weakness). However, the BOE is forecasting a recession beginning 4Q22 and lasting throughout 2023. Neither the ECB or Fed have made similar statements about an oncoming recession to date.

The FT says moving 20mn - 25mn tons of grain trapped in Ukraine necessitates at least 371 loadings of medium-sized vessels. This is nearly 2x what many of the smaller vessels carry. The current shipment on the Razoni is one of these smaller vessels.

This is NOT to say we should not transition to different energy sources. Instead of being a value judgment masquerading as science, these are the facts as we know them based on historical analysis. Fossil fuels will be an important part of our energy mix for the decades to come. These fuels accounted for over 80% of energy consumption.

One could go deeper into sub-elements by looking at the the specialized cells.

Being from Texas, when I say football I mean American football.

Psychological studies have shown individuals with a high sense of coherence have better levels of psychological well-being, positive moods/emotions (called “affect” in psychology), and meaning in life. Sense of coherence (SOC) refers to the coping capacity of people to deal with stressors and consists of: comprehensibility, manageability, and meaningfulness.

While many systems have feedback loops, it is not a requirement.

When the Pandemic first hit, one analogy I liked was the 1980 supply shock when Carter imposed credit controls, which sent the US economy into a tail spin. The similarity was a government imposed slowdown/recession for those that understood this and the quick rebound, as in 1980, was less of a surprise. Today, I like an analogy from WSJ's Jon Hilsenrath who says the Pandemic is like dropping a large rock into an aquarium--the still waters of equilibrium are chaotically disturbed which are still oscillating today...However as in Physics, these oscillations, the peaks and troughs ought to be reverberating into lower amplitude cycles...So far, I am not sure that is obvious...

Interesting read. I believe the perception gap is of outsized importance in our systems. Humans are slow in responding to change.

Thinking errors like: X GWH of renewables could replace X GWH of fossil fuel base generation, without properly considering that renewables are semi-randomly interruptible.

One cannot replace completely fossil fuels with renewables, unless demand also is semi-randomly interruptible. Or the system can get as close as possible to instant on and instant off of those FF generation units, to provide maximum benefit from renewables without demand interruption.

However, this means the backup fossil fuel capacity needs to equal to the highest delta in renewables. That is expensive today.